Welcome to Moodys Private Client

Moodys Private Client is the home of Moodys Tax Law, Moodys Private Client Law, and Moodys Private Client Accounting. We bring together Canadian and US legal and accounting professionals experienced in tax, law, and accounting to ensure you’re covered from every angle. Whether you’re a business owner, a C-suite executive, a professional athlete, or are building your good fortune in one of many other ways, our goal is to unite your success with our expertise and ensure the situations in your life where tax, accounting, and legal are concerned feel as easy and stress-free as possible.

We offer timely, bespoke, creative, and fire-tested solutions to protect your wealth and help you take advantage of opportunities. By offering these services under one roof, we are able to see everything from an elevated perspective, arrive at answers before they become questions, and chart the best path forward for your individual situation.

Together, we’ll explore what’s possible.

Upcoming Webinar...

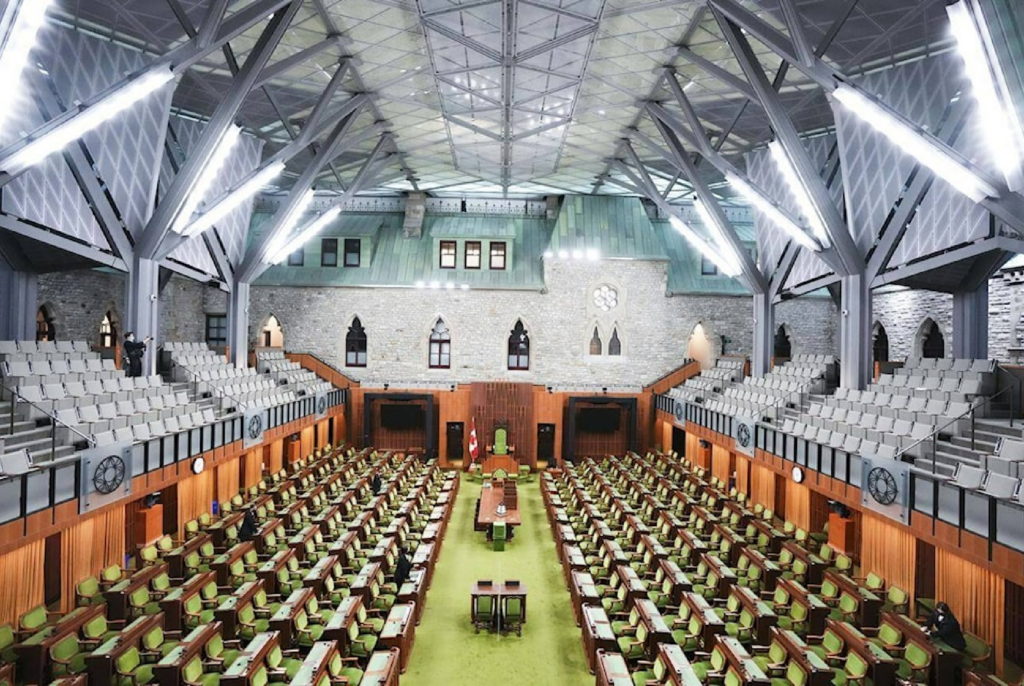

Our Review of the 2024 Federal Budget

Join us for an in-depth analysis of the latest Federal Budget. What does it mean for the future of Canadians?

Webinar: Wednesday, April 17, 2024

Upcoming Webinar...

Is Now the Right Time to Renounce Your US Citizenship?

Complimentary webinar for US citizens living in Australia, New Zealand & Asia

Webinar: Saturday, April 20, 2024

Upcoming Webinar...

Have You Heard About The E-2 Investor Visa?

US IMMIGRATION OPTIONS FOR CANADIAN INVESTORS, ENTREPRENEURS, AND SNOWBIRDS

Webinar: Wednesday, April 24, 2024

Upcoming Webinar...

Is Now the Right Time to Renounce Your US Citizenship?

Complimentary webinar for US citizens living in Canada, the Caribbean, Latin America.

Webinar: Saturday, May 4, 2024

US Citizenship Renunciation

Is now the time to renounce your US citizenship?

Make the right decision for you and your family.

Our team of US lawyers represent over 400+ US citizens to properly renounce their citizenship every year. We will help you assess if renouncing your US citizenship is right for you. If you decide to renounce, we work with you through every step to make sure the process is as smooth as possible, while avoiding the negative consequences of renouncing the wrong way.

Click below to learn more about our approach or to register for one of our upcoming complimentary webinars.

Latest Updates & News

Insight on what’s happening in the world of tax,

law, and accounting so you can stay ahead.

Our Review of the 2024 Federal Budget: An In-Depth Analysis

On April 16, 2024, the government of Canada released its Budget 2024. Overall, this budget can be characterized as a very heavy spending budget with continued large deficits, no fiscal anchor, increasing public debt charges (now estimated to be a whopping $54.1 billion for the upcoming year.

Canadian Citizenship 101: How To Become a Canadian

Have you thought about becoming a Canadian citizen? There are many benefits of becoming a Canadian citizen, including access to healthcare, global mobility, and the ability to renounce another citizenship that may no longer serve your needs.

Have you ever wondered how much your US citizenship is costing you? Why renouncing could save you hundreds of thousands and open new doors for financial opportunities.

As US expats prepare for another expensive and stressful tax filing season, we’ve compiled a list of items that illustrate a few of the standard costs of their US citizenship while living abroad – in addition to the headaches, stress and sleepless nights that come with it.

Alexander Marino recently appeared on the Global Investment Voice Podcast to discuss the benefits of renouncing US citizenship on March 14, 2024.

Alexander Marino guested on the Snowbirds US Expats Radio Podcast about the benefits of renouncing your US citizenship on January 17, 2024.

Kenneth Keung and Evan Crocker are quoted in Investment Executive article titled “CRAʼs 10% interest rate on overdue tax raises risks“, published on November 13, 2023.

Kenneth Keung quoted in Investment Executive article titled “Window closing on family business transfers using Bill C-208”, published on October 10, 2023.

Kim G C Moody is quoted in the Tax Notes article titled “Canada’s Supreme Court Upholds GAAR Application in Deans Knight”, May 30, 2023

Moodys Private Client Blog + News in Your Inbox

Never miss a major development that might impact your bottom line with the best of our blog sent direct.