Latest Updates & News

Insight on what’s happening in the world of tax,

law, and accounting so you can stay ahead.

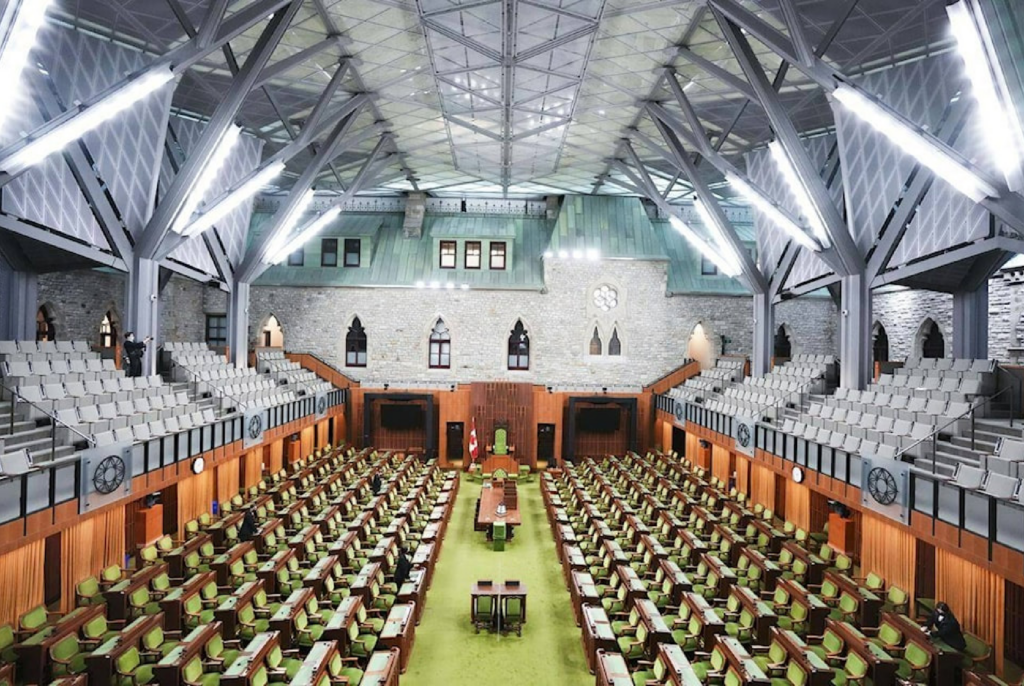

Our Review of the 2024 Federal Budget: An In-Depth Analysis

On April 16, 2024, the government of Canada released its Budget 2024. Overall, this budget can be…

Canadian Citizenship 101: How To Become a Canadian

So, You Wanna Be a Canadian? Since the signing of the Immigration Act, 1976 into legislation almost…

Have you ever wondered how much your US citizenship is costing you? Why renouncing could save you hundreds of thousands and open new doors for financial opportunities.

The weeks and months leading up to June 15 are typically referred to as tax season for…

Alexander Marino recently appeared on the Global Investment Voice Podcast to discuss the benefits of renouncing US citizenship on March 14, 2024.

Alexander Marino guested on the Snowbirds US Expats Radio Podcast about the benefits of renouncing your US citizenship on January 17, 2024.

Kenneth Keung and Evan Crocker are quoted in Investment Executive article titled “CRAʼs 10% interest rate on overdue tax raises risks“, published on November 13, 2023.

Kenneth Keung quoted in Investment Executive article titled “Window closing on family business transfers using Bill C-208”, published on October 10, 2023.

Kenneth Keung and Evan Crocker are quoted in the Investment Executive article titled “Tougher minimum tax regime poses planning challenge”, May 8, 2023

Moodys Private Client Blog + News in Your Inbox

Never miss a major development that might impact your bottom line with the best of our blog sent direct.